Export supply side

The setup of SMART is that, for a given good, different countries compete to supply (export to) a given home market. The focus of the simulation exercise is on the composition and volume of imports into that market. Export supply of a given good (say banana) by a given country supplier (say Ecuador) is assumed to be related to the price that it fetches in the export market. The degree of responsiveness of the supply of export to changes in the export price is given by the export supply elasticity. SMART assumes infinite export supply elasticity - that is, the export supply curves are flat and the world prices of each variety (e.g., bananas from Ecuador) are exogenously given. This is often called the price taker assumption. SMART can also operate with finite elasticity - upward sloping export supply functions which entails a price effect in addition to the quantity effect.

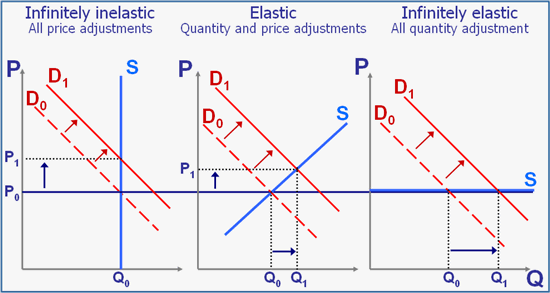

The following graphics depicts the adjustment process when the demand curve moves to the right (more imported quantity for a given price) in three situations which differ only by the type of elasticity of supply.

- Supply elasticity is infinitely inelastic: the market adjusts only through price (P0 to P1) since the quantity offered by suppliers is fixed.

- Supply elasticity is infinitely elastic: the market adjusts only through quantity (Q0 to Q1) since suppliers can meet with level of demand at the same price (P0).

- Supply elasticity is somehow elastic: the market adjusts through both price and quantity (P0 to P1 and Q0 to Q1).

Next: Demand side: the Armington Assumption

WITS Online Help

The World Bank, 2010